Everything you need to know about cashflow

How to improve your cashflow

When you run a business, it’s important to keep a close eye on the money coming in and going out - especially during times of rising costs. Here are six simple tips to help you track, control and improve your cashflow.

Make sure your invoices are accurate

We can all be guilty of the odd typo, but try not to make mistakes in your invoices. If you do - and a customer queries the invoice - you might have to issue a new one, which will likely increase the time it takes for you to get paid.

To avoid any unnecessary back and forth, double-check that you’ve included the correct items and prices, plus your payment details and your customer’s details on your invoices. If you’re VAT registered, pay extra attention to make sure your invoices include everything that HMRC requires.

Top tip - another way to get paid quicker is to streamline your payment process with payment solutions, such as those provided by Tyl by NatWest, Stripe, GoCardless and PayPal.

Keep your business and personal finances separate

It’s much easier to keep track of your cashflow if you keep business and personal finances separate. It will give you a clearer picture of what’s coming into, and going out of, your business.

If you’re running a limited company, having a separate account for the company is a must. If the company is using a bank account that’s personal to one of the directors, any money left in there could be treated as money the company owes the director, which would incur additional tax.

Sole traders and partnerships should also keep a separate bank account so it’s easy to keep business and personal transactions separate.

If you use accounting software like FreeAgent, you can set up a bank feed so all of your transactions are imported into your FreeAgent account automatically. And with AI-powered smart categorisation, you’ll save even more time on bank reconciliation.

Chase late payers promptly

Chasing customers for unpaid invoices can be time-consuming and let’s face it, a little awkward. But if you want a healthy cashflow, it’s unavoidable. To help with this, FreeAgent lets you set up automatic late payment reminder emails that chase your customers for payment - giving you back valuable time to focus on running your business.

You can even customise the timing and wording of these email reminders, which allows you to take a slightly stronger tone if you need to give those persistent late payers a firmer nudge. Check out our dedicated guide for more tips on dealing with the late payment of invoices.

Encourage your prompt payers

If your customers do pay you on time, it’s a good idea to send them a thank you note to let them know you appreciate it. This sort of positive reinforcement is a simple way to build customer relationships, and encourage your customers to continue to pay promptly. In addition to late payment reminders, you can set up automatic thank you emails from FreeAgent, giving you one less thing to think about.

Review your customer base

Identifying the customers who pay you later than others can help eliminate some of the uncertainty of your cashflow forecasting. It might also make you reconsider working with them again! FreeAgent’s Radar feature identifies your five slowest-paying customers based on their late payments over the past year. When you’ve identified them, here are a few different approaches you can take.

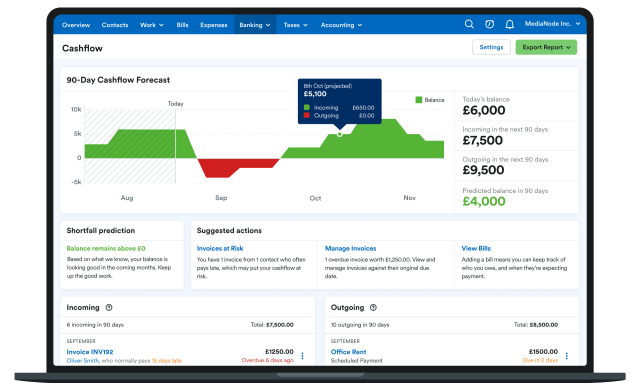

Understand your near-term cashflow data

Having a clear understanding of what the near future holds for your business is crucial when it comes to making the right decisions. FreeAgent’s Cashflow forecast enables you to do just this by providing data-driven projections about how much money you’re likely to spend and receive in the next 90 days.

Not using accounting software yet? Try a 30-day free trial and see how FreeAgent’s award-winning software can help you improve your cashflow and make smarter business decisions.