Applying the reduced VAT rate in FreeAgent

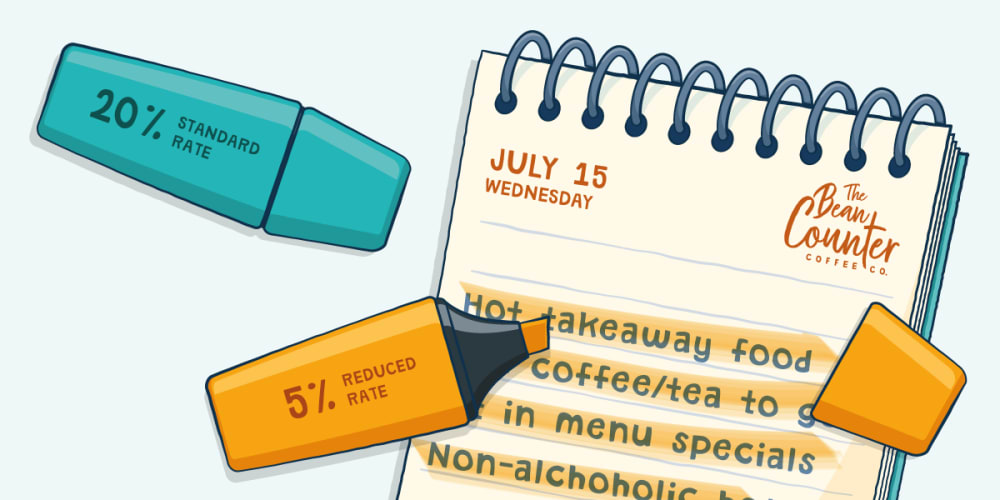

As part of last week’s Summer Economic Update, the government has announced a temporary reduction in VAT for the hospitality and tourism sectors. This will see the VAT rate for businesses in these industries change from the standard rate of 20% to the reduced rate of 5%. Here’s what you need to know in order to apply the reduced VAT rate to your transactions in FreeAgent quickly and easily.

Which transactions are applicable?

The reduced VAT rate will apply to the supply of food and non-alcoholic drinks from restaurants, pubs, bars, cafes and similar premises between 15th July 2020 and 31st March 2021. The same reduction will apply over the same period to the supply of accommodation and admission to attractions. You can find more detailed information on the government’s website.

How to apply the reduced VAT rate to your transactions

If any of your purchases qualify, you can apply the reduced VAT rate in FreeAgent when you create bills and expenses and when you explain your bank transactions. You can also apply the reduced VAT rate to your invoices and to any sales that you record as bank transactions. Simply follow the steps in this Knowledge Base article to apply the reduced rate of VAT to your purchases and sales in FreeAgent.

Ready to relax about tax? FreeAgent’s accounting software keeps you up to date with what you owe and automatically generates your VAT returns based on your data.

Disclaimer: The content included in this blog post is based on our understanding of tax law at the time of publication. It may be subject to change and may not be applicable to your circumstances, so should not be relied upon. You are responsible for complying with tax law and should seek independent advice if you require further information about the content included in this blog post. If you don't have an accountant, take a look at our directory to find a FreeAgent Practice Partner based in your local area.