More flexible asset depreciation options

We’re delighted to announce that exciting updates to our capital asset and depreciation functionality are now live. There is now greater flexibility over the methods you can use to calculate depreciation and how frequently the ledger entries are posted.

We’ve added support for the following:

- The reducing balance method of depreciation

- Assets that don’t depreciate, such as land and investments

- Assets depreciating on a monthly basis

- Asset lifetimes of up to 25 years when depreciating using the straight line method

- A more detailed capital asset report

And that’s not all - new FreeAgent accounts will soon contain default nominal codes for land and property assets. You’ll also soon be able to choose a default depreciation method to be applied to all new capital asset types, view a ‘Net Book Value’ running balance for individual capital assets and export the Capital Assets report.

These updates will not only save you valuable time when entering capital asset purchases, they’ll help support your clients who have more sophisticated accounting needs. Being able to post more accurate and frequent ledger entries for an asset’s depreciation will potentially give a more realistic reflection of your client’s accounts at their year end. The Capital Assets report will also better reflect the depreciation of assets.

Previously, capital assets could only be depreciated using the straight line method and for a maximum of seven years in FreeAgent, with depreciation ledger entries posted on an annual basis. All these factors meant journals were a regular requirement for handling capital assets.

Here are the details.

Greater flexibility over how assets are depreciated

When recording the purchase of a capital asset in FreeAgent, you have the option to select whether you’d like the depreciation to be calculated using the straight line method or reducing balance method, or for the asset not to depreciate at all.

These more flexible options are also available for recording asset purchases on the go using the FreeAgent mobile app.

When depreciating an asset using the straight line method, you have the option to choose an asset life of up to 25 years.

When depreciating an asset using the reducing balance method, you have the option to enter the relevant percentage to apply a particular rate of depreciation to the asset.

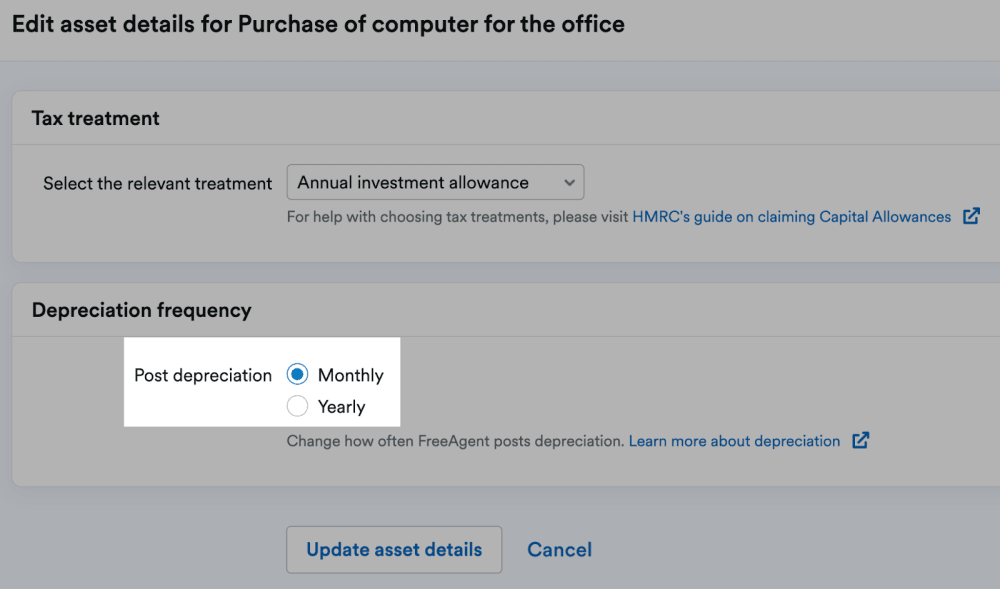

Greater flexibility over the depreciation frequency

On the Capital Assets report, you can choose whether the depreciation ledger entries for individual assets should be posted on a monthly or annual basis.

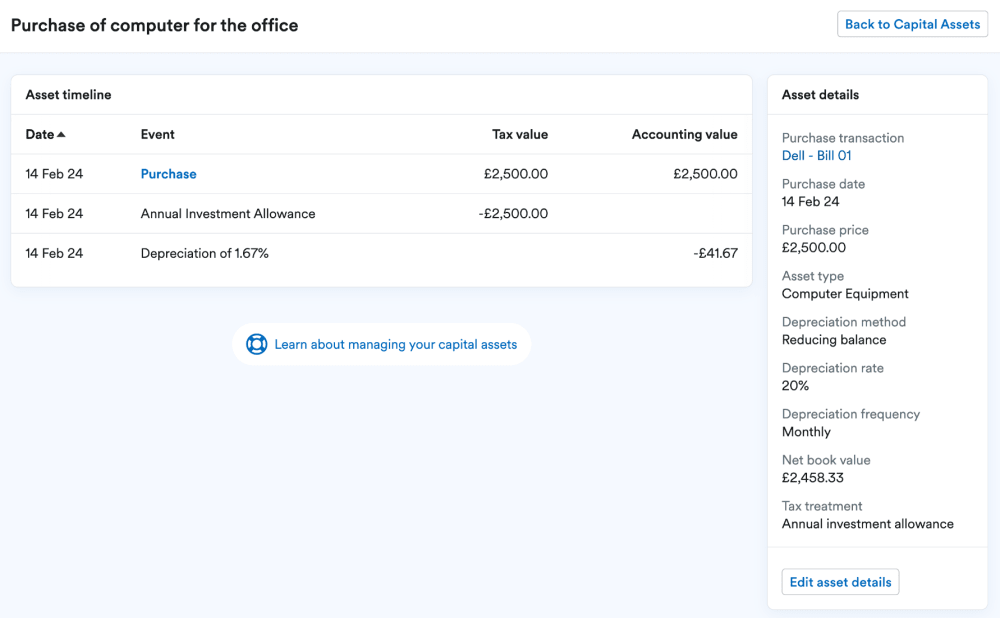

Improved reporting of assets

The Capital Assets report now contains additional data to better reflect the depreciation of assets. There are new columns to show the asset type, the depreciation method and the asset purchase price.

Originally published

Last updated