How to claim a refund if you overpaid on your Self Assessment tax bill

If you pay too much Income Tax, HMRC may owe you a refund - which would obviously be welcome news! Below we explain how to find out if you’re due a refund for overpaid Income Tax and what steps you’ll need to take to claim it from HMRC.

There are usually two ways you end up paying too much Income Tax. One is by having an incorrect amount of tax deducted ‘at source’ - in other words, before you receive the money - from income such as dividends, salary and bank interest.

The other way you might pay too much Income Tax is by entering incorrect figures for your other income sources when you complete your Self Assessment. For example, if you miss a significant business cost off your tax return.

The steps you’ll need to take to find out if you are due a tax refund and make a claim depend on which of the above ways you overpaid.

If you had too much Income Tax deducted at source

How will I know if I’m due a tax refund?

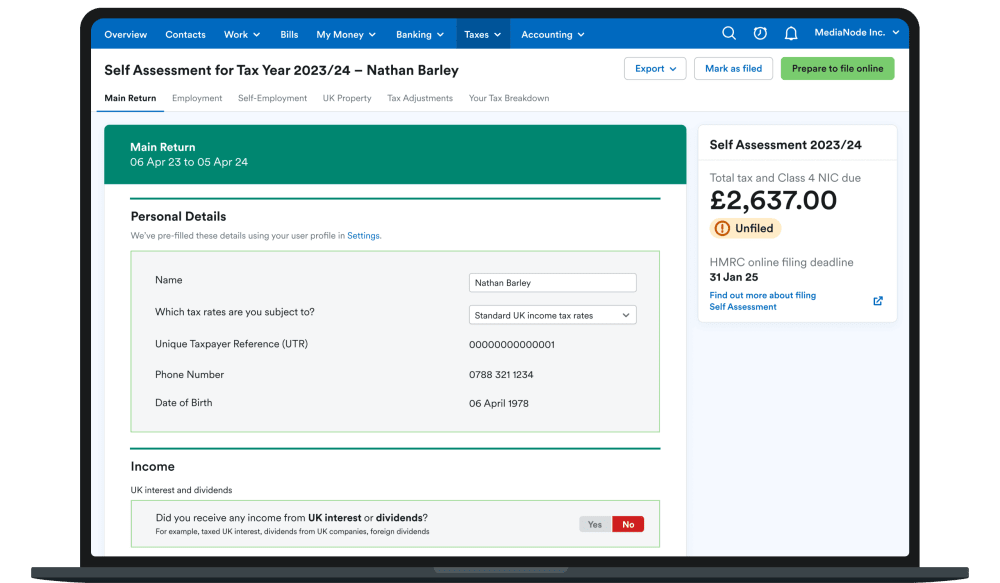

The good news is that it’s pretty straightforward. If too much Income Tax was deducted at source from income such as dividends, salary and bank interest, you’ll see an on-screen message telling you that you are due a tax refund when you submit your Self Assessment tax return online via HMRC’s website, or if you use third-party software like FreeAgent.

This information should also be visible when you log in to either your Self Assessment or personal tax account on HMRCs website, or on the Tax Breakdown of your tax return in FreeAgent.

How will I get my refund?

In this scenario, you don’t need to do anything as you should receive the refund from HMRC automatically. HMRC will usually refund you within two weeks of submitting your return and will issue the refund to the last credit or debit card that was used to make a payment on the Self Assessment account.

It’s also worth noting that in some cases, HMRC may reduce your next tax bill instead of issuing a refund if you are due to pay tax in the next 45 days.

If you’re using FreeAgent, once the refund has been paid into your bank account by HMRC, you’ll need to explain it correctly.

If you made an error on your Self Assessment tax return

How will I know if I’m due a tax refund?

If you think you might have made a mistake when you first submitted your Self Assessment, you’ll need to submit an amended tax return first.

When you complete the amended tax return, either through FreeAgent or directly through HMRC, you’ll need to enter the required information in the appropriate boxes on the tax return and state how you’d like to receive the payment for the refund. Be sure to include your bank account number and sort code if you’d like the money to be refunded to your bank account.

How will I get my refund?

If, after reviewing your amended tax return, HMRC agrees that you’re due a tax refund, you’ll receive a letter of confirmation. Please be aware that HMRC will never email, text or send other electronic messages about tax refunds. It’s worth checking the guidance on recognising scams if you’re unsure about any emails or messages you’ve received from HMRC.

You will usually receive your tax refund within two weeks. Please note that HMRC may reduce your next tax bill instead of issuing a refund if you are due to pay tax in the next 45 days. If you’re using FreeAgent, once the refund has been paid into your bank account by HMRC, you’ll need to explain it correctly.

If HMRC doesn’t agree that you’re owed a tax refund, or requires further information to support your claim, they’ll send you a letter to let you know.

If you don’t receive your refund or hear from HMRC within four weeks of the date you submitted your claim, you can check your online account via HMRC or check the status of your query to see when you can expect a reply.

If you’re unsure about which type of overpayment you’ve made, HMRC has a handy tool to help you identify if you’re due a tax refund and how to claim it.

Want to feel more confident filing your Self Assessment tax return?

FreeAgent is the only accounting software that lets small businesses and landlords file Self Assessment directly to HMRC. Save time, reduce stress and make the Self Assessment season more straightforward. Start your free 30-day trial in time for the 31st January Self Assessment filing deadline.

Disclaimer: The content included in this blog post is based on our understanding of tax law at the time of publication. It may be subject to change and may not be applicable to your circumstances, so should not be relied upon. You are responsible for complying with tax law and should seek independent advice if you require further information about the content included in this blog post. If you don't have an accountant, take a look at our directory to find a FreeAgent Practice Partner based in your local area.