Late filing penalty reprieve for some taxpayers affected by basis period reform

More than 1.1 million taxpayers missed this year’s Self Assessment deadline of 31st January - and will therefore be liable for a £100 fine. But HMRC has confirmed some business owners affected by basis period reform will have a temporary reprieve.

If you requested details of your overlap figure on or before 31st January and are still awaiting that information from HMRC, you will not receive a late payment penalty. This grace period will extend until 28th February.

The original advice to agents and taxpayers was to file their return with provisional figures and then correct later, as HMRC wouldn’t accept not having an overlap figure as a reasonable excuse. However, HMRC has now confirmed its decision to waive penalties for those still waiting for a reply from them after 31st January.

An HMRC spokesperson said: “We informed customers requesting details of their overlap relief online that if they did not receive a response from us by the 31st January filing deadline, they would not incur a late-filing penalty provided they filed by 28th February 2025.”

If you are among those still waiting for your overlap figure, you should still file your tax return as soon as possible, said FreeAgent’s Chief Accountant Emily Coltman. “Businesses should include a provisional figure for their overlap relief in order to be able to work out their tax as closely as possible,” she added. “If they understate their profits, HMRC will charge them interest on any shortfall of tax they pay.”

In a news digest sent to their stakeholders in January, HMRC confirmed: “Interest will still accrue from 1st February on outstanding amounts of tax.”

How will I know if I’m affected by basis period reform?

Prior to 6th April 2024, a business’s basis period usually covered the same dates as its accounting year. For example, if your year end was 31st December, then for the tax year 6th April 2022 - 5th April 2023, you would pay tax on the profit you made in the calendar year 2022. This is because your accounting year-end date that fell between 6th April 2022 and 5th April 2023 was 31st December 2022.

Now, however, the rules have changed - and if you previously had an accounting year end that was not between 31st March and 5th April, you will have to adapt to comply with basis period reform.

From 6th April 2024, all self-employed individuals and partners in partnerships have to report their business tax information to HMRC on a tax year basis, regardless of their accounting period. Effectively, everyone’s basis period now runs from 6th April to the following 5th April.

If you have previously been preparing your accounts to a date other than 31st March - 5th April, you’ll probably have paid tax twice on the same profits in the early years of trading (these profits are called overlap profits).

In 2023-24, as you transition to paying tax on the profit your business made in the tax year rather than the accounting year, you are able to deduct any overlap profits from the profit you would otherwise pay tax on (this is called overlap relief).

However, some businesses’ overlap profits happened so long ago that they don’t have a record of what they were. HMRC therefore set up an online tool to allow you to request those details.

If you have used this tool before 31st January to ask for your overlap profit figure but HMRC didn’t get back to you before that date, you will be among those who have until 28th February 2025 to file your tax return without incurring a late filing penalty.

Are there other reasonable excuses accepted by HMRC for late filing?

Yes, HMRC accepts reasonable excuses that are “something that stopped you meeting a tax obligation for a valid reason” - it must be an issue you couldn’t have reasonably avoided. If you think this might apply to you, find out more about how to appeal a Self Assessment penalty.

If you have received a Self Assessment penalty and are unsure how to pay, read our article on how to pay a Self Assessment penalty.

Can FreeAgent help me navigate the new basis period rules?

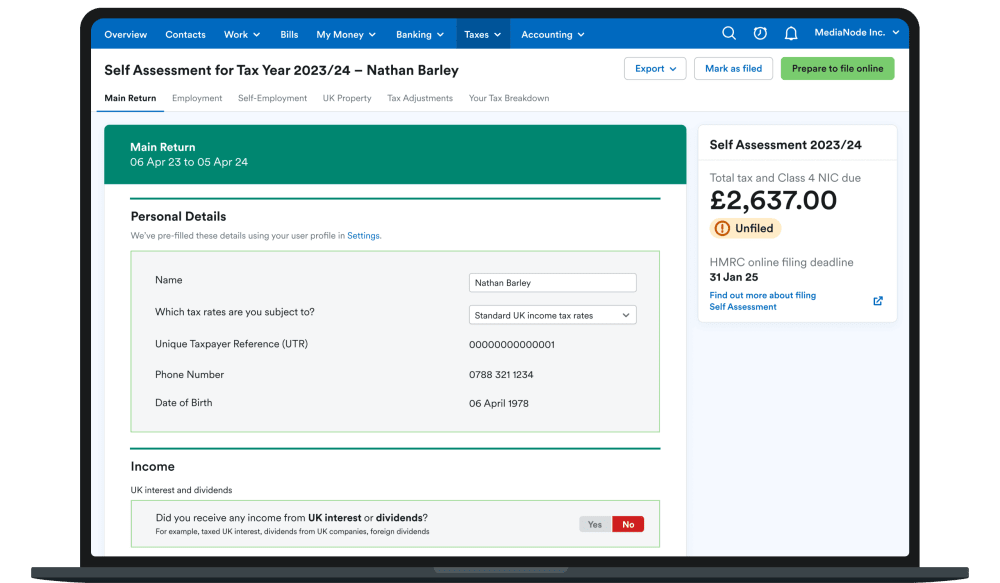

Yes - for 2023/24 and going forward, FreeAgent will calculate your transitional profits for you and apportion them to the correct basis period for tax. As well as helping you to steer your way through the new basis period rules, FreeAgent has loads more features to simplify your business accounting. You can use FreeAgent to automate your daily admin, calculate your tax responsibilities and remind you of deadlines.

Try a 30-day free trial of the friendliest accounting software (ICB Luca Awards 2024, 2023, 2022, 2020 and 2019) and take some pressure off your next tax return.

Originally published

Last updated

Disclaimer: The content included in this blog post is based on our understanding of tax law at the time of publication. It may be subject to change and may not be applicable to your circumstances, so should not be relied upon. You are responsible for complying with tax law and should seek independent advice if you require further information about the content included in this blog post. If you don't have an accountant, take a look at our directory to find a FreeAgent Practice Partner based in your local area.