How to protect your business from late payment problems

Late payments, excuses, radio silence - we’ve all experienced problems getting paid. In fact, new research by FreeAgent has discovered that 43% of all invoices sent in the last year by UK freelancers and small businesses were paid late. That’s 43% more than we’d like, so we’ve pulled together a few ideas on how to handle late-paying customers.

The best and worst areas for late payment

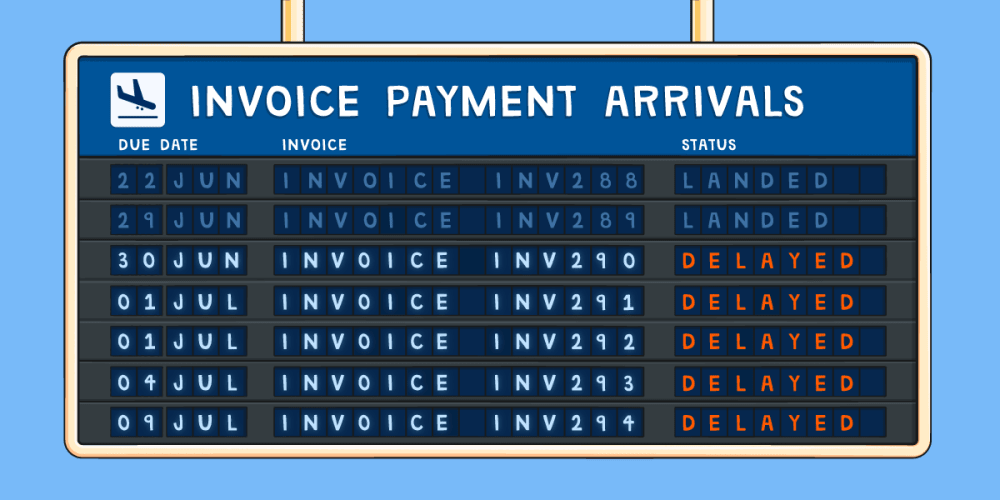

Our research looked at invoice data from June 2022 to June 2023 across 150,000 UK small businesses, and we can reveal the best and worst areas of the country for businesses to get paid. Drum roll please…

Harrow is the worst area of the country for getting paid, with 64% of invoices paid late to Harrow-based businesses. Snapping at its heels are Guildford, Nottingham and Liverpool, each with 61% of invoices paid late. However, small businesses can breathe easier in Ipswich, where just 5% of invoices were paid late.

While the numbers are disappointing overall, the trend is in the right direction. The percentage of invoices paid late has dropped from 46% to 43% since we last conducted this study in 2020. While there’s still a long way to go, businesses can see a glimmer of hope ahead.

Why are late payments such a problem for small businesses?

While one late payment might not initially seem like the end of the world, small businesses have to deal with late payments every couple of months on average. And that has some serious knock-on effects!

Businesses plan to have a positive cashflow most of the year, so there’s more money being paid in than they are spending. But late payments can throw off these careful plans, meaning that a business might have a negative cashflow and in extreme cases, not be able to pay their bills. While chasing payment can remind forgetful customers, this can take valuable time away from running the business.

Late payment is one of the biggest causes of small business failure. “The vast majority of small businesses simply don’t have the luxury of being able to absorb late payments into their accounts - they need to get paid promptly to keep themselves afloat,” said Roan Lavery, co-founder and CEO at FreeAgent.

Small business solutions to the late payment problem

Many small business owners have called for the government to take steps to address the late payments problem. Our research found that 41% of FreeAgent users would like better access to legal aid and services, 38% want to see harsher financial penalties for late payers and 34% want the Prompt Payment Code to become compulsory for all private sector contracts.

But there are also some simple steps you can take to reduce the likelihood of late payments:

- Learn the rules for charging interest or fees for overdue invoices

- Make the consequences of late payment clear in all your contracts

- Automate away chasing late payments - FreeAgent can do that for you

- Make payment easier for your customers by adding a payment link to your invoice

- Offer a payment plan to let customers struggling with their own cashflow pay in instalments

- Consider taking legal action if a customer goes AWOL or refuses to pay

Want to see how FreeAgent can help you get paid on time? Try our 30-day free trial and test out creating invoices, sending them out to customers and automating reminders and thank you messages.