How to measure practice success with KPIs

Your main focus may be helping your clients to ensure that their businesses thrive but it’s important to keep an eye on how your practice is performing as well. One of the most effective ways of doing this is to set key performance indicators (KPIs).

KPIs can help you evaluate the health of your practice over time by highlighting both the areas that are performing well and those that need some extra attention. Here’s a rundown of some KPIs that may help you measure your accounting practice’s success.

Before you set KPIs for your practice

There are a few factors to consider before you decide which KPIs to set for your accountancy practice:

Know your goals

Try to relate your KPIs to your practice’s goals so that you can measure the progress you’re making towards them. For example, if your goal is to increase your client base, you may have a KPI on the number of new client leads that come into the practice.

Keep your KPIs simple

KPIs allow you to focus on what’s really important to your practice, so try to make them as clear as possible and avoid setting more KPIs than it’s possible to track.

Make them manageable

For KPIs to work effectively they should be straightforward to monitor. Consider how regularly you’re going to report on your KPIs, which tools you’ll need to gather the information and how long it will take you to pull the data together.

Make sure your targets are realistic

Try to set targets against your KPIs that are realistic but ambitious so that you and your team have something challenging and achievable to work towards. Consider the timescale you’re working within and base your targets on relevant data, such as your practice’s current performance and industry averages.

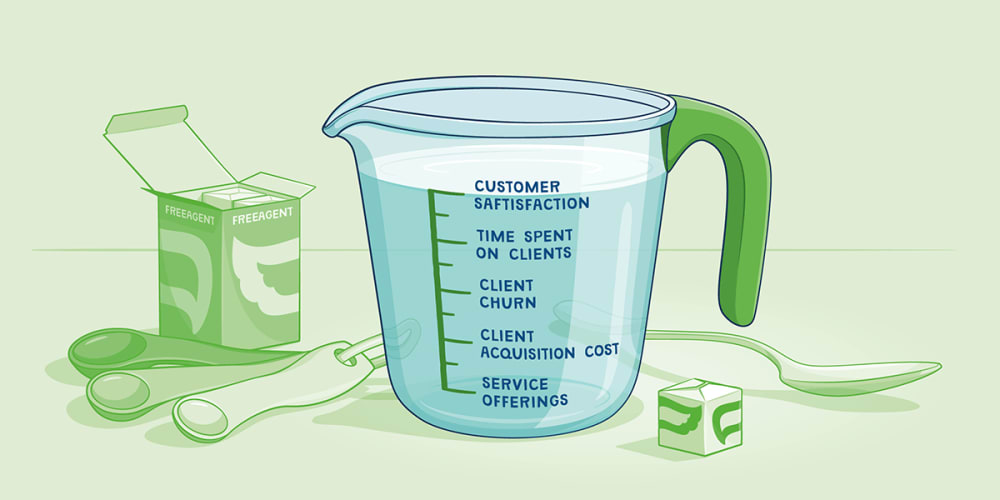

Some KPIs to consider tracking

The KPIs you choose to monitor will depend on your practice’s strategic objectives. However, these suggestions may be helpful to consider:

Client satisfaction

Knowing how your clients feel about your services can give you insights into what you’re doing well and what you could improve. Happy clients can help your practice grow as they’re more likely to refer you to other potential clients.

You can measure client satisfaction by tracking your practice’s Net Promoter Score (NPS) or by monitoring customer feedback on review sites like Trustpilot.

Client churn

Client churn - the rate at which clients stop using your practice’s services - can be a useful KPI to consider tracking.

If client churn affects your practice, you can measure the churn rate by dividing the number of clients who left in a certain period of time by the total number of clients you had at the beginning of that period. You can multiply this number by 100 to express the churn rate as a percentage.

If your practice’s churn rate increases over time, you may want to investigate the reason for it and take steps to address the situation, like encouraging clients to use the FreeAgent mobile app. Our research shows that clients who use the app to record their transactions and share their data with their accountant are less likely to churn than clients who don’t use the app.

Client acquisition cost

Tracking how much it costs your practice to acquire new clients can help to demonstrate whether your marketing strategy is working effectively.

To work out your client acquisition cost, divide the amount your practice spent on acquiring new clients in a certain period by the number of new clients that joined the practice in the following period. Comparing this cost with the average lifetime value of your clients can indicate whether your marketing budget and strategy should be reviewed.

Time spent on clients

Setting a KPI on the amount of time that you and your team spend on individual clients could highlight potential areas for improvement. If a particular client requires significantly more time and resources than others, it may indicate that the client or their account manager requires additional support or training.

Time spent on service offerings

The time you and your team spend delivering each of your practice’s services could be a helpful KPI to track, particularly if your practice has an objective to spend more time on certain services than others.

If the aim is to focus on advisory services but you find that you and your team spend most of your time balancing books for your clients, you may want to consider whether clients should take on some administrative bookkeeping tasks with your support.

Using FreeAgent, your clients could record their business expenses, send invoices and explain bank transactions, sharing their numbers with you automatically. This would give you more time to analyse your clients’ figures and provide them with expert business advice.