New tax year: what’s on the horizon for accountants and bookkeepers?

The 2025/26 tax year is just around the corner! To help you get ahead of the upcoming changes, we’ve rounded up the key headlines. From National Insurance updates to Making Tax Digital (MTD), here’s what you need to know.

1st April

National Minimum Wage rise

The National Minimum Wage for 18 to 20-year-olds will rise to £10 an hour (a 16.3% increase), while the National Living Wage for those aged 21 and over will jump to £12.21 (6.7% increase). 16-17-year-olds and apprentices will see a rise to £7.55 (18% increase).

Business Rates Relief for retail, hospitality and leisure

Eligible retail, hospitality and leisure (RHL) properties in England will get 40% relief (reduced from 75%) on their business rates liability - up to a cash cap of £110,000 per business. The small business multiplier in England will freeze at 49.5p, but the standard multiplier will increase to 55.5p.

6th April

Increase in Employer National Insurance contributions

One of the main focus areas for practices will be the increase in National Insurance (NI) contributions - from 13.8% to 15% on salaries exceeding £5,000. Previously, Employer NI was paid on earnings exceeding £9,100. This has been a hot topic for businesses and accountants should be aware of the additional stress it may place on clients. They’ll need help navigating the financial implications, including adjusting budgets, updating payroll systems and managing cashflow strategies.

Employment Allowance increase

The Employment Allowance will rise from £5,000 to £10,500 and the £100,000 eligibility threshold will be removed. However, note that limited companies where only one employee (who’s also the director) is on payroll still won’t qualify for Employment Allowance.

For full details of how employers should pay towards all National Insurance, including rebates and special rates, check the HMRC website.

Rise in Capital Gains Tax (CGT) rates

The rate on gains subject to business asset disposal relief and investors’ relief will increase from 10% to 14% for disposals made on or after 6th April 2025. The rate will rise again to 18% for disposals made on or after 6th April 2026, so you and your clients will need to plan accordingly. The Capital Gains Tax rate for carried interest will increase to 32%, and carried interest will be brought into the Income Tax Framework from the 2026/27 tax year.

Increased interest rates for late tax payments

Late payment interest is charged on unpaid taxes, including Income Tax, Capital Gains Tax and some National Insurance contributions when they are not paid by the relevant deadline. The rate is currently set at the Bank of England base rate plus 2.5%, which puts the current interest payable at 7%. As part of the government’s attempt to ‘close the tax gap’, this rate is set to increase by 1.5 percentage points to the base rate plus 4%.

Changes to the Furnished Holiday Lettings (FHL) tax regime

The Furnished Holiday Lettings (FHL) tax regime will be abolished. FHL properties will be treated as part of the owner’s UK or overseas property business, and be subject to the same tax rules as non-FHL properties, such as less generous capital allowances. This affects individuals, corporates and trusts who operate or sell FHL accommodation.

Introducing advanced electronic signatures

Tax advisers will need to provide an Advanced Electronic Signature when making certain income tax repayment claims.

One year to Making Tax Digital for Income Tax

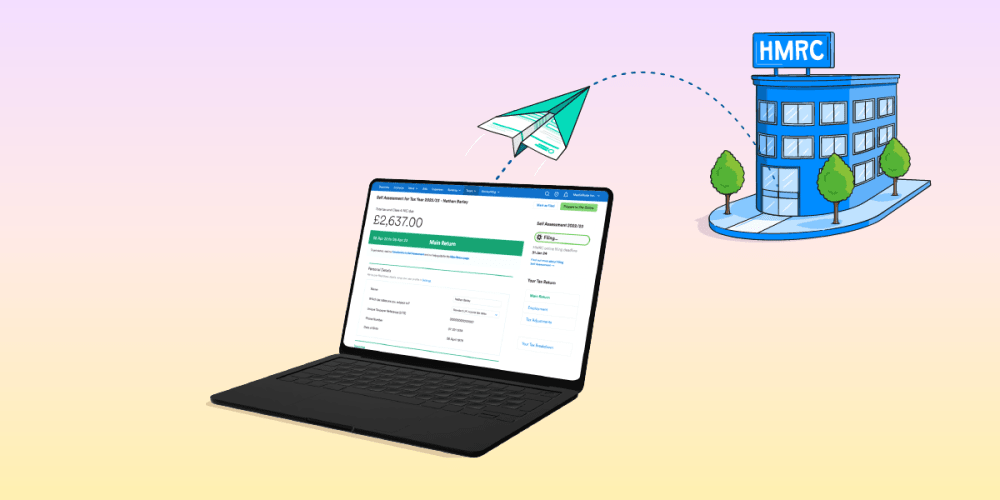

Last but not least, the Government is set to bring MTD for Income Tax into the mainstream from April 2026. This initiative will require self-employed individuals and landlords with qualifying income to maintain digital records and update HMRC each quarter using compatible software. During the 2025/26 tax year, accountants will need to start moving clients to compatible software, to ensure they’re fully prepared.

MTD for Income Tax will apply to self-employed individuals and landlords with qualifying income (not profit) of over £50,000 from April 2026, and to those with qualifying income of over £30,000 from April 2027. MTD for Income Tax will also be extended to sole traders and landlords with income over £20,000 from April 2028.

As part of the Chancellor’s commitment to “closing the tax gap”, late payment penalties for MTD for VAT and MTD for Income Tax will increase from April 2025.

The new rates for VAT-registered businesses from 6th April 2025 will be:

- 0-14 days late: no penalty

- 15-29 days: 3% of the amount outstanding at day 15

- 30+ days: 3% of the amount outstanding at day 15 plus 3% of the amount outstanding at day 30

There will also be a penalty of 10% of the amount outstanding added per annum, on top of the penalties listed above.

These new rates will also apply to anyone submitting MTD for Income Tax submissions - which will be mandatory for most self-employed individuals and landlords with an income over £50,000 from April 2026

Check out our handy MTD resources to help prepare your practice. You can also watch our demonstration of FreeAgent’s MTD solution for an overview of the quarterly submission functionality.