How to tell HMRC about a change to your personal details

As a small business owner, when any of your personal details change, you need to let HMRC know about these changes. In this article, we explain why it’s important for HMRC to ask for your up-to-date details and the steps you need to take to inform them of any changes.

Changes to name or address

If you change your name or your permanent address, you’ll need to tell HMRC so they can update their records and are able to contact you when necessary. Failing to do this could lead to problems with your taxes, such as missing the deadline to file a Self Assessment tax return or pay a tax bill. In some circumstances, you could even face a fine for failing to notify HMRC of a change of address.

You can tell HMRC about a change of name via the government website. You can also update your address on the government website or by using the official HMRC app.

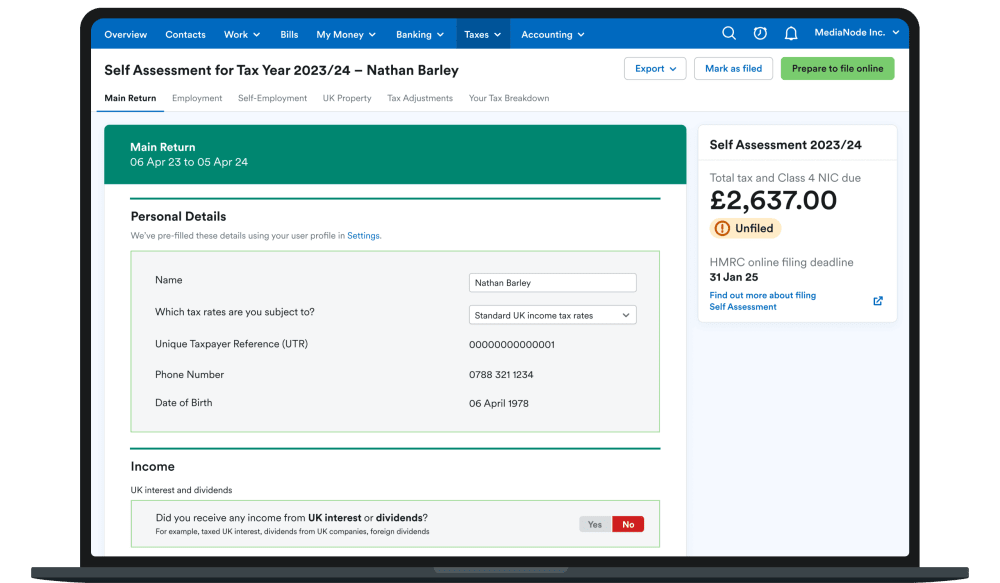

If you need to file a Self Assessment tax return, your details will be updated automatically once you’ve reported a name or address change and your new name or address will appear on your next tax return.

Changes to income

It’s very important to tell HMRC about changes to your taxable income, such as a new source of income or if you start or stop receiving taxable benefits, so that you don’t pay too much tax or receive an unexpected Self Assessment tax bill at the end of the year.

You must tell HMRC separately about changes that affect your tax credits or changes to your income after the death of a spouse or civil partner.

Changes to relationship or family

A change to your relationship or family circumstances can have tax implications as a small business owner if you’ve previously been including child benefit payments or transferring or receiving marriage allowance, on your Self Assessment tax return.

If your relationship changes, for example, if you get married, form a civil partnership, divorce, separate or stop living with a spouse or civil partner, you must tell HMRC. This is important so that you don’t pay too much tax or receive an unexpected Self Assessment tax bill.

You should also inform HMRC about any change to your relationship or family if you receive tax credits or Child Benefit payments because credits and payments may need to be updated.

How to tell HMRC about changes

How you contact HMRC to update any of the above details depends on whether you only pay tax through Self Assessment or if you’re someone who HMRC calls a tax agent, such as an accountant.

If you only pay tax through Self Assessment

If you already have a personal or business tax account, you can update your personal details using HMRC’s online services. You’ll need a Government Gateway user ID and password in order to do this.

If you don’t have a personal or business tax account or user ID, you’ll need to create one via the Government Gateway login page.

Alternatively, if you’re self-employed or in a partnership, you can write to the address on the most recent correspondence you have from HMRC or call the Income Tax helpline.

If HMRC needs to contact you about anything confidential they’ll reply by phone or post.

If you’re a tax agent

If you’re a tax agent, you can use HMRC’s online services. You’ll need an agent services account to use these services.

If you don’t have an agent services account, you can create one when you use one of HMRC’s online services for agents for the first time. However, if you’re a new agent, you must first register as an agent by post before you can create an account.

Alternatively, tax agents can update these details by calling the dedicated helpline or by post.

Changes to your business details

It’s also important to tell HMRC if any of your business’s details change such as the business name, address, legal structure, bank details, payroll details or if you’re closing or selling your business. HMRC provides more information about how to do this on its website.

Not using FreeAgent yet? Try a 30-day free trial today and see how our award-winning software’s insights and accounting reports can help you make smarter business decisions.

Disclaimer: The content included in this blog post is based on our understanding of tax law at the time of publication. It may be subject to change and may not be applicable to your circumstances, so should not be relied upon. You are responsible for complying with tax law and should seek independent advice if you require further information about the content included in this blog post. If you don't have an accountant, take a look at our directory to find a FreeAgent Practice Partner based in your local area.