Everything you need to know about digital record keeping

When it comes to running your business, how should you keep track of the information that really matters, such as your financial records? For many businesses, digital record keeping is the best solution.

What is digital record keeping?

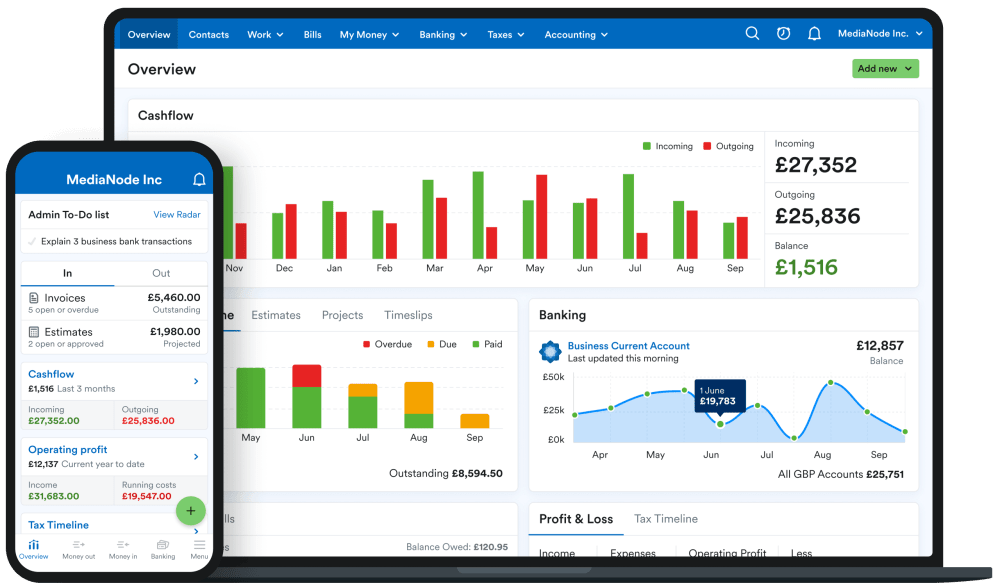

The phrase ‘digital record keeping’ refers to the practice of keeping business records electronically, as opposed to the traditional method of keeping paper records such as a box of receipts. For example, over 200,000 UK businesses use FreeAgent’s accounting software to manage their business finances and keep digital records.

Why is it important?

For VAT-registered businesses, digital record keeping is not only a great way to manage financial records; it’s also a legal requirement. The government’s Making Tax Digital (MTD) initiative currently requires all businesses that are registered for VAT to maintain digital records and file their VAT returns through software like FreeAgent. In 2026, the expansion of MTD will require self-employed individuals and landlords with income over £50,000 to keep digital records.

However, you don’t have to be VAT-registered or wait until 2026 to start keeping records digitally. Here are some reasons to get started right away:

Benefits of digital record keeping

1. Hassle-free expense tracking

When it comes to managing your business expenses, keeping digital records means you can say goodbye to mountains of messy paperwork. HMRC will usually accept scanned copies of receipts, so rather than keep a box full of old receipts you can scan them and store them digitally using software.

According to HMRC, 61% of business owners have lost receipts in the past, so keeping digital records is a great way to reduce the risk of losing important information. For example, the FreeAgent mobile app is full of features designed to make it easy for our customers to capture and store images of receipts and record the data in their accounts. This means you don’t have to worry about fishing out old receipts when it’s time to file your tax return.

2. Better financial and tax planning

One of the government’s stated aims for MTD is that it should “make it easier for individuals and businesses to get their tax right” - and most digital tax software is built with this aim in mind.

For example, FreeAgent can help get your accounts in order for digital VAT and Self Assessment filing with minimal hassle. Our Open Banking bank feeds save you time and effort by automatically importing transactions from linked bank accounts. And our Tax Timeline features provides a real-time overview of how much VAT and Income Tax you owe and when you’ve got to pay each.

If you work with an accountant, giving them access to your digital records through your accounting software lets them see your most up-to-date financial data in real time. This allows them to give you advice and guidance throughout the year and work with you to address any issues as they arise.

3. More time for you

HMRC has reported that the most “digitally engaged” people save a day a week in administration. If you’re tired of losing huge amounts of time on preparing your VAT returns, keeping your business records digitally will help you keep on top of your financial admin throughout the year.

Digital accounting software isn’t just for desktop computers, and you can often also manage your business finances on the go. For example, the FreeAgent mobile app allows you to complete many business admin tasks - such as recording expenses, creating and sending invoices and explaining bank transactions - while you’re on the move.

And when it comes to submitting MTD-compatible VAT returns, FreeAgent takes the data you’ve entered throughout the year and populates the relevant returns automatically within the software. All you have to do is check the information over and then file the return directly to HMRC with the press of a button.

If you’re a sole trader or limited company director, FreeAgent can also automatically populate parts of your Self Assessment tax return. For example, when it’s time to file, parts of the Self Employment form will already be filled in - just like magic!

Ready to get started?

FreeAgent’s accounting software is designed with all small businesses in mind, and many have shared their stories of falling in love with this way of working.

Find out more about FreeAgent’s award-winning accounting software for small businesses.

Disclaimer:The content included in this glossary is based on our understanding of tax law at the time of publication. It may be subject to change and may not be applicable to your circumstances, so should not be relied upon. You are responsible for complying with tax law and should seek independent advice if you require further information about the content included in this glossary. If you don't have an accountant, take a look at our directory to find a FreeAgent Practice Partner based in your local area.