How to calculate your business income for Self Assessment

This article was written by FreeAgent’s Content team and our Chief Accountant, Emily Coltman FCA.

If you’re a self-employed sole trader and you’re in the process of preparing your annual Self Assessment tax return, you might be wondering what figure to enter in the ‘business income’ box on the Self Employment pages. This guide explains how to calculate this figure if you keep your business accounts to 5th April each year.

1. Check the dates of the income you’re declaring

Before you begin calculating your income, make sure that the income you’re including is dated between 6th April and 5th April of the relevant tax year. Don’t include income from an earlier or later year unless you’re sure it should be counted.

2. Declare income according to your chosen accounting method

From April 2024, cash basis accounting, where income or costs are recorded at the date the money is either received or paid out, is the default accounting method for self-employed businesses and partnerships with trading income. However, businesses can opt to use accruals basis accounting if they wish.

The method of accounting you’re using will dictate which business income to include in your Self Assessment tax return:

Accruals basis accounting

If you’ve opted to use the accruals basis accounting, you must declare all of the income that you earned during the tax year that you’re filing for.

This means that if you issued an invoice in the 2024/25 tax year and your customer paid during the 2025/26 tax year (after 5th April 2025), you should declare the income in your 2024/25 tax return, which covers the tax year in which you issued the invoice.

However, if you provide a service through your business, you should declare your income in the tax year in which you complete the work rather than the tax year in which you invoice for it. For example, if you completed a piece of work in 2024/25 but did not invoice for this work until the 2025/26 tax year, you should declare that income in your 2024/25 tax return.

Cash basis accounting

If you use cash basis accounting, you must only declare the income that you received during the tax year that you’re filing for.

This means that if you issued an invoice in the 2024/25 tax year and your customer paid during the 2025/26 tax year (after 5th April 2025), you should not declare the income in your 2024/25 tax return.

If you’re in any doubt about which business income to declare on your tax return, or which method of accounting you’re using, you should speak to an accountant.

**Further reading**: You can find out more about [the differences between cash basis accounting and accruals basis accounting](https://www.freeagent.com/guides/small-business/accruals-basis-accounting-vs-cash-basis-accounting/) in our dedicated guide.

3. Only include business income on the Self Employment pages

When you’re completing the Self Employment pages of your tax return, you should only include the trading income from your business. This means that you shouldn’t include any of the following additional sources of income:

- Employment - this refers to the income you earn from any job you have in addition to running your business (remember that the work you do for your own business does not count as employment). Income you earn from employment should be declared on the Employment page of your Self Assessment tax return.

- Bank interest - you should declare this income on the Main Return page of your tax return, even if you earned interest on a business bank account during the tax year.

- Transfers from a personal bank account into a business bank account during the tax year - you’re not required to declare this on your tax return.

- Money that you put into the business during the tax year - you’re not required to declare this on your tax return.

- Money that you inherited during the tax year - you should speak to an accountant about whether you should declare this income on your tax return.

This list is not exhaustive, so if you’re unsure about whether any income you have earned during the tax year qualifies as trading income from your business, you should seek advice from an accountant. In addition, you might want to take a look at the additional information about this topic on the government’s website.

4. Treat VAT appropriately if your business is VAT-registered

If your business is VAT-registered, the way you should account for VAT when declaring your self-employed business income will depend on whether your business is on the VAT Flat Rate Scheme.

If your business is on the Flat Rate Scheme, you should include the difference between the VAT you charged to your customers and the flat rate of VAT you paid to HMRC in the amount of business income you declare.

If your business is not on the VAT Flat Rate Scheme, you should exclude VAT from the amount of business income you declare on your tax return.

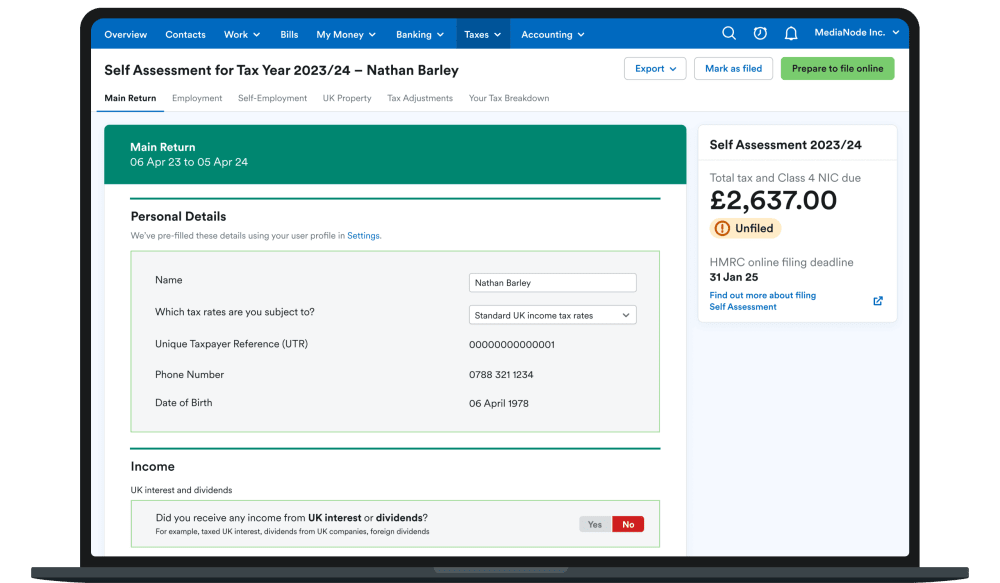

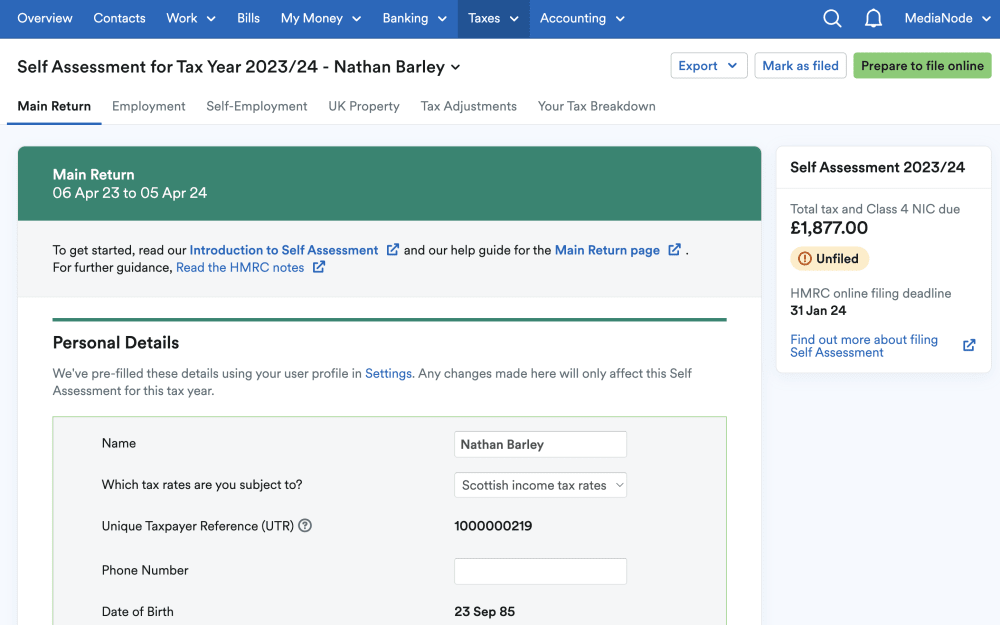

Using FreeAgent to file Self Assessment online

An alternative approach to calculating your self-employed business income for Self Assessment is to let FreeAgent do much of the hard work for you.

Our award-winning accounting software uses the data you enter through the year to pre-populate parts of your Self Assessment tax return, including the business income box on the Self Employment pages. FreeAgent can even calculate your tax bill.

When you’re ready to file your completed Self Assessment tax return, you can submit it to HMRC directly from FreeAgent with the click of a button.

When you’re ready to file your completed Self Assessment tax return, you can submit it to HMRC directly from FreeAgent with the click of a button. Find out more about filing your tax return directly to HMRC with FreeAgent.

Disclaimer: The content included in this guide is based on our understanding of tax law at the time of publication. It may be subject to change and may not be applicable to your circumstances, so should not be relied upon. You are responsible for complying with tax law and should seek independent advice if you require further information about the content included in this guide. If you don't have an accountant, take a look at our directory to find a FreeAgent Practice Partner based in your local area.