What is a VAT return?

Definition of a VAT return

A VAT return is a form you file with HMRC, usually four times a year, to show how much VAT you are due to pay them. If you’re not registered for VAT, you won’t file VAT returns.

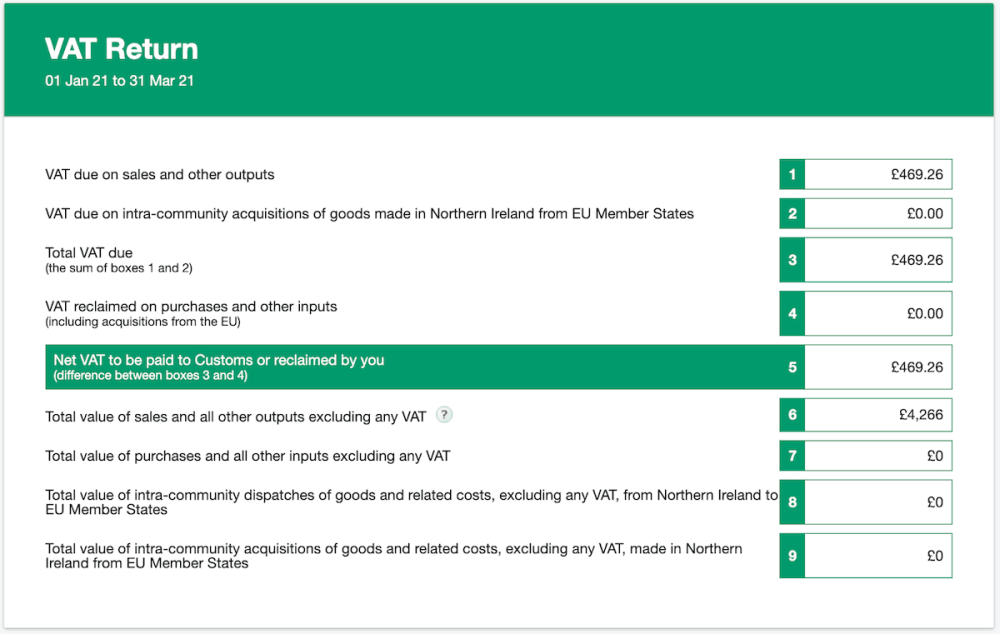

The VAT return shows the calculation of the amount of VAT due on sales minus the amount of VAT reclaimable on purchases. The result is the amount payable to HMRC.

If the amount reclaimable on purchases is more than the amount due on sales, HMRC will give you the difference back!

Want to know more about VAT? Our handy introduction to VAT guide has all the information you need.

How to file your VAT return

You can file your VAT return through HMRC’s own website, or can use an online accounting service like FreeAgent which will help you fill in your VAT return, then allow you to submit it directly to HMRC for you.

Example of a VAT return

This VAT return example was created using FreeAgent.

Calculating VAT

Need a hand calculating VAT? Use our VAT calculator to add or remove VAT at the standard or reduced rate.

Disclaimer: The content included in this glossary is based on our understanding of tax law at the time of publication. It may be subject to change and may not be applicable to your circumstances, so should not be relied upon. You are responsible for complying with tax law and should seek independent advice if you require further information about the content included in this glossary. If you don't have an accountant, take a look at our directory to find a FreeAgent Practice Partner based in your local area.