How to create a bookkeeping system for your small business

This article was written by FreeAgent’s Content team and our Chief Accountant, Emily Coltman FCA.

If you’re thinking about starting your own business (or have already started), then you’ll need a way to keep track of your finances, understand how your business is performing and - when the time comes - file your tax return with HMRC. In order to do this, you’ll need your very own bookkeeping system.

Before you go any further

In the rest of this guide, we’ll outline what a great bookkeeping system looks like and give you some ideas about how to build one for your business.

Here’s the twist though: you don’t actually have to build anything, as we’ve already built one for you. It’s called FreeAgent and it even wins awards.

Find out more about why you should make the move to FreeAgent.

If you’re still interested in building your own bookkeeping system for your business, we can help with that too. Here are a few things to think about to get you started:

Getting started

Before you start putting together a bookkeeping system for your business, you’ll need to think about what records you’re going to keep, how you’re going to organise them and how you’ll store them.

Important

If your business is registered for VAT (or you expect it to be in the future), then you should also know that the government’s Making Tax Digital initiative now requires all VAT-registered businesses to keep digital records and use compatible software to submit VAT returns electronically. This means you won’t be able to use paper for your bookkeeping, and you’ll only be able to use a spreadsheet if it can talk to HMRC’s online portal digitally via ‘bridging software’ with no manual re-keying.

You can find out more information about Making Tax Digital in our dedicated hub.

1. What records are you currently keeping?

The first step is to review your current situation. Grab a pen and a piece of paper and jot down a list of what records you’re already keeping. You’ll need to transfer these records to your new bookkeeping system once you’ve set it up.

2. What records do you need to keep?

The next step is to understand what records you need or want to keep, and if there’s anything that you’re not currently recording that you should be.

It’s a legal requirement to maintain accurate business records and you’ll need to hold on to them for several years in case HMRC ever asks to inspect them.

In addition to keeping you compliant with tax law, your bookkeeping system should be able to help you answer some key questions about your business at any time.

In the table below we’ve outlined these questions and the information you’ll need in order to answer them:

| Questions | What you'll need |

|---|---|

| How much money is coming into your business? | A record of all the money your business has received over a period of time. |

| How much money is going out of your business? | A record of all the money your business has spent over a period of time. |

| Is your business making more money than it’s spending? | A comparison of the money going into and going out of your business over a period of time. |

| How much money does your business have in its bank account? | The balance of the bank account you use for your business. |

| What invoices have you issued? | A record of all the invoices you’ve issued over a period of time. |

| What running costs have you incurred? | A record of your business’s day-to-day running costs over a period of time. |

| Does your business’s income outweigh its running costs, i.e. has it made a profit? | A profit and loss account, showing what your business has earned and what day-to-day running costs it’s incurred, over a given period of time. |

| Does anyone owe your business money? | A record of any unpaid invoices you’ve issued. |

| Does your business owe any money? | A record of any unpaid bills. |

| What allowable business expenses have you incurred? | A record of which of your business costs over a period of time are allowable expenses. |

You’ll also need to make sure your records show what taxes you owe, such as VAT, Income Tax and Corporation Tax (if your business is a limited company).

3. How will you organise your bookkeeping system?

Once you’ve got an idea of the information you’ll be keeping in your bookkeeping system, you’ll want to think about how to organise it. A lot will depend on whether your system is going to be digital (i.e. stored on a computer or online) or written down on paper - so it’s important to decide this before you go any further!

Although we’d obviously recommend that you use a purpose-built software like FreeAgent to keep your books organised, using spreadsheet software like Excel or Google Sheets will usually cause you fewer headaches than trying to manage everything by hand on paper - particularly as the law requires you to keep business records for at least five years after the 31st January tax return submission deadline of the relevant tax year.

You’ll need to factor all of this in when deciding how to organise your bookkeeping, as your life will be a lot simpler if you can easily tell which records relate to which tax year.

If you’re using software like Excel or Google Sheets, this may be as simple as creating a new copy of a document for each tax year and implementing a folder system for different tax years.

Further reading: You can find out more about organising your financial paperwork in our dedicated guide.

4. How will you keep your bookkeeping system safe?

You’ll also need to think about how you’re going to store and organise your bookkeeping system. A lot will depend on whether your system is digital or on paper.

If you’re keeping paper records, you’ll want to make sure that they’re kept somewhere secure and where they won’t be accidentally damaged. You might also want to think about keeping backup copies in another location in the event of a fire or flood.

If you’re keeping digital records, you’ll need to think about security and where you’re storing your files. If they’re on one computer only, what happens if it breaks or gets damaged? Keeping your files in cloud storage is one solution to this, and services such as Google Drive and Dropbox are popular options.

5. Do you need to share your bookkeeping with anyone?

If you work with an accountant, it’s worth thinking about how you’ll share your bookkeeping system with them. When you do this right, your accountant will be able to give you helpful, proactive advice and become a really trusted adviser for you and your business.

In the (hopefully) unlikely event that you find yourself on the receiving end of a tax investigation from HMRC, you’ll also need to share your records with them - so make sure your system is easy for anyone to understand.

Further reading: You can find out more about HMRC tax investigations in our dedicated guide.

Ideas for creating your bookkeeping system

Once you’ve established what information you need in your bookkeeping system and how you’ll organise and manage it, you’re ready to get started.

If you’ve followed the steps outlined above, you’ll have a good idea about what information you need to include and how you want to organise it. To help you along, here are a few key things to track and some ideas on how to do so.

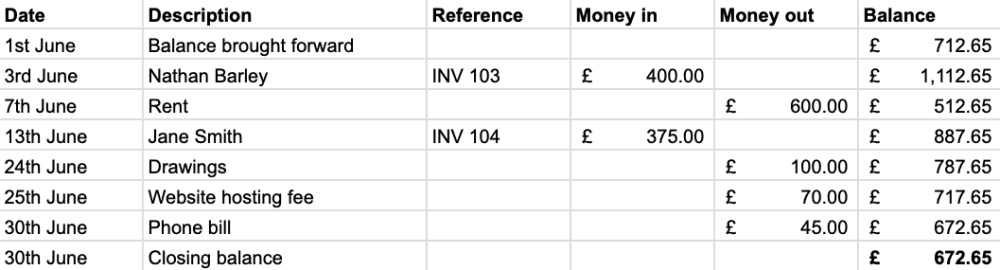

Your money in and money out

Keeping a record of your money in and money out is the backbone of your bookkeeping system. Whether you’re using a pen and paper, a spreadsheet or another way of managing your finances, this can be as simple as jotting down all of your receipts, payments and a running balance for the week, month or even year that you’re keeping a record of.

You can see a simple example of what this might look like below:

Can FreeAgent do this? Yes. FreeAgent tracks money in and out of your bank account using live bank feeds, helping you keep your business on the right trajectory.

Invoices you send

Your bookkeeping system should also be able to tell you what invoices you’ve issued and whether customers have paid you. You can track this quite simply by noting down every invoice you send, including important information such as:

- the customer name

- the invoice number

- the amount invoiced for

- the date you issued the invoice

- the date that payment is due

- whether the customer has paid the invoice or not

If you’re using a spreadsheet, you can track this in a different tab from your other information - or on a different piece of paper if you’re still doing things the old-fashioned way!

Can FreeAgent do this? Yes. FreeAgent lets you issue invoices, allocate receipts, then see what’s been paid, what’s due and what’s overdue. You can even get those pesky late payers to cough up quicker with automated email reminders.

Allowable expenses you incur

You can also use your bookkeeping system to track any allowable expenses you incur in the course of running your business. If you want to include these expenses when you file your tax return, you’ll need a record of them along with the relevant receipts.

You can track this by keeping a record of any expenses you wish to include in your tax return in your bookkeeping system. At minimum, this should include information such as:

- the date of the expense

- a description of what the expense is

- what category the expense belongs in, e.g. travel

- the amount you’re claiming for the expense

- a copy of the receipt for the expense (where applicable)

If you’re using a spreadsheet for your bookkeeping system, you may want to invest in a scanner. This will allow you to scan any relevant receipts and keep them in a digital storage space such as Google Drive or Dropbox. You can then link to this from your spreadsheet.

It might also be helpful to add additional information such as notes to your bookkeeping system.

Can FreeAgent do this? Yes. FreeAgent lets you track all the expenses you incur while running your business, whether you pay for these yourself or the business pays for them. You can track bank payments and scan receipts directly to the software, so there’s no reason to forget to record an expense again.

Bills you need to pay

If you’re not paying business costs immediately, you also need to keep a dedicated record of any bills you have to pay. This will help you plan ahead better and know in advance how much money you expect to pay out over a period of time.

The details to keep here would include a record of:

- the supplier who’s billing or invoicing you

- a description of what you’re being billed for

- the category you’re putting the bill into

- the amount due

- when you have to pay the bill

You may also wish to note when you’ve paid a bill so that you’ve got a better idea of what’s outstanding.

Can FreeAgent do this? Yes. FreeAgent lets you add one-off and recurring bills to your account, so you can keep track of the money going out of your business and won’t be caught off guard by any surprise payments or forget to pay any of your suppliers.

Take a free trial of FreeAgent

Following the guidance we’ve outlined above should help you create a bookkeeping system that works for your business, but there’s really no need to do so - FreeAgent has all the features you need!

Sign up for a 30-day free trial of FreeAgent to try it for yourself.

Disclaimer: The content included in this guide is based on our understanding of tax law at the time of publication. It may be subject to change and may not be applicable to your circumstances, so should not be relied upon. You are responsible for complying with tax law and should seek independent advice if you require further information about the content included in this guide. If you don't have an accountant, take a look at our directory to find a FreeAgent Practice Partner based in your local area.