Claiming expenses for the cost of food and drink

We all need to eat to live, but when does food become a business expense that you’re allowed to claim tax relief on? In a nutshell, you can claim the cost of your own food and drink when you’re travelling for business. However, the rules are different if you’re an employee (including of your own limited company) or if you’re self-employed.

Self-employed

As a self-employed person, HMRC says you can claim “reasonable” costs of food and drink when you’re travelling for business, if:

- your business is by nature itinerant (for example, you’re a commercial traveller)

- you’re making an “occasional business journey outside the normal pattern”, for example, you’re a home-based illustrator and you travel to London to meet a new publisher

- you stay overnight on a business trip and claim the cost of accommodation as well as meals

HMRC has extended this to “traders who do not use hotels”, and say specifically that long-distance lorry drivers who sleep in their cabs can also claim the cost of their meals, even though they’re not claiming the cost of accommodation.

What counts as a “reasonable cost”?

In the case of food and drink for the self-employed, HMRC doesn’t give a definition of what a “reasonable” expense is. However, the guidance on meals for employees says that “elaborate meals with fine wines” are not on a “reasonable scale”.

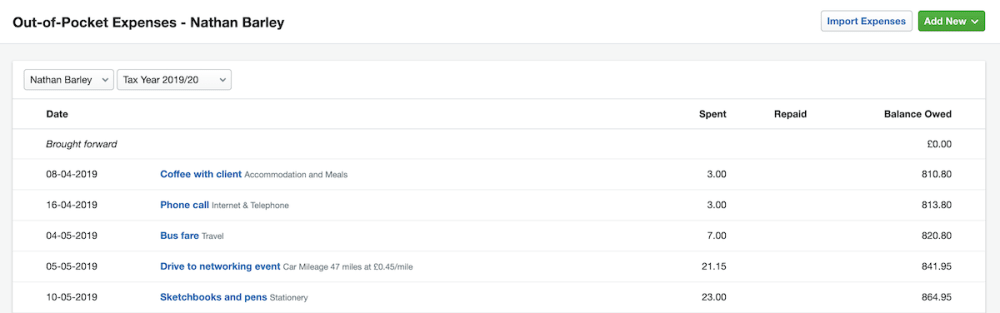

Recording food and drink expenses in FreeAgent

Using the FreeAgent mobile app, you can snap photos of receipts and record your food and drink expenses on the go. Upload your expenses from wherever you are and keep your accounts in FreeAgent up to date across all your devices.

Find out more about the FreeAgent mobile app

Employees

If you’re an employee, you may have some meals provided by your employer - for example, if your workplace has a staff canteen. However, if you pay for meals when you’re travelling for business, you can usually claim that cost back from the business.

When does the cost of food and drink not count as a taxable benefit?

The basic rule is that if you can claim the cost of the travel, you can claim the cost of the meal because for employees, HMRC includes meals under “the necessary cost of business travel”. The journey does not need to include an overnight stay, or be outside your normal patterns of business travel.

For more information, take a look at HMRC’s guide to travel and accommodation expenses.

Disclaimer: The content included in this guide is based on our understanding of tax law at the time of publication. It may be subject to change and may not be applicable to your circumstances, so should not be relied upon. You are responsible for complying with tax law and should seek independent advice if you require further information about the content included in this guide. If you don't have an accountant, take a look at our directory to find a FreeAgent Practice Partner based in your local area.