How many bank accounts does your business need?

With so many different types of business bank accounts available, you might be wondering which ones you need. There’s no easy answer, but to help you decide, here’s a quick guide to the common types of business bank accounts in the UK.

How many bank accounts should your business have?

There isn’t a limit on the number of bank accounts your business can have. In theory, you could open as many as you want, as long as your bank approves each application. However, having your business finances split across several bank accounts might become confusing and most businesses tend to opt for a simpler setup with a few accounts that are easy to keep track of.

How should you set up accounts for your business?

How you set up your business bank accounts will depend on your business’s needs. Your business type, for example, is a big factor: limited company directors are required to open a bank account for their company that’s separate from their personal finances, whereas a sole trader or a partner in a partnership could potentially run their business using their personal account.

Be aware that there are several reasons why it’s not a good idea to mix your personal and business finances, which we’ve outlined in this guide to whether you need a business bank account.

The most common types of bank accounts used by businesses in the UK include:

Business current account

At a bare minimum, you’ll need a current account to process your business transactions. This is the main account for your business. Not all business current accounts are the same, so you should have a good look around to find one that suits your business needs. For example, with NatWest, Royal Bank of Scotland or Ulster Bank business current accounts, or a Mettle bank account, you can get FreeAgent accounting software free of charge for as long as you retain your account. Optional add-ons may be chargeable.

Find out more about getting our award-winning accounting software for free.

Business savings account

With most business current accounts your money is unlikely to earn much interest over time, but with a business savings account your money will earn interest. You may also decide to keep an additional savings account to ensure you put enough away to pay your tax bills and so you’re not tempted to spend what you owe to HMRC.

With the Tax Timeline in FreeAgent it’s easy to see a projection of how much tax you have to pay and when you have to pay it, so you can ensure you put away enough to cover your bills.

Other types of accounts to consider

Credit cards

Company credit cards can help business owners keep track of work-related expenses incurred by their employees. Credit cards could be used to buy train tickets, office supplies, postage or any expense that can be claimed for in the employer’s accounts. Check out our A to Z of expenses to find out more about the types of expenses you can claim for.

Business loan accounts

If your business has taken out a loan, it’ll be kept in a separate account. This will help you understand how many repayments you’ll have to make and how this will affect your cash flow.

Petty cash

Some businesses keep a small fund on hand to pay for minor expenses like office supplies or reimbursement. Though petty cash by definition deals with small amounts, it’s still important to keep track of this in your accounts, and linking a petty cash account to your main accounts is a good way to do this.

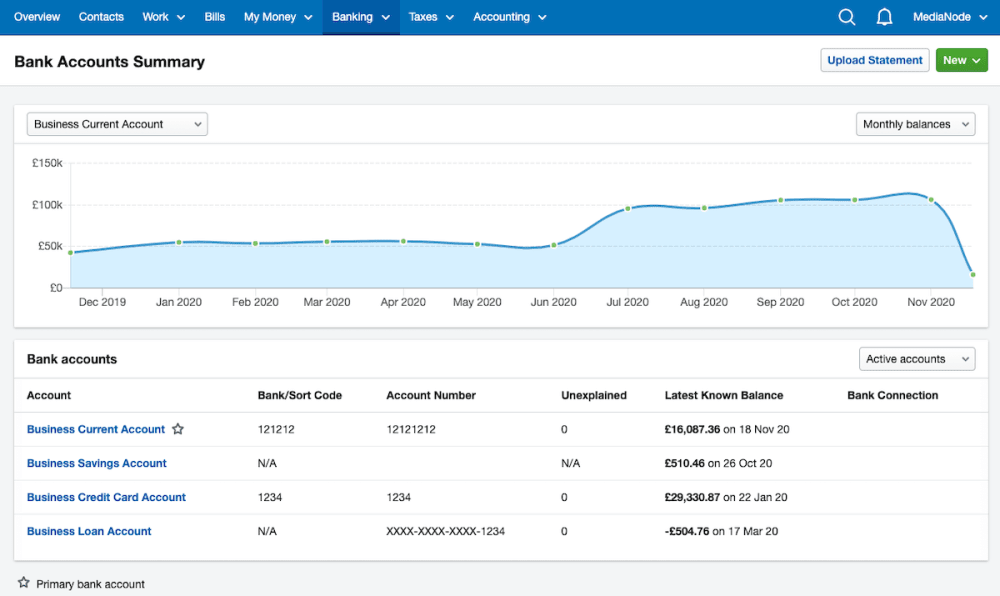

Keeping track of the money in all your business bank accounts with FreeAgent

With FreeAgent, you can connect your bank accounts using bank feeds in order to track all your incomings and outgoings and get a clear picture of how much money you have across your accounts.

Find out more about banking in FreeAgent.

Get further advice

We’ve listed various types of accounts that businesses in the UK can use to manage their finances, but that doesn’t mean that you should open them all. It’s a good idea to sit down with your accountant or advisor and think carefully about what your business needs from its banking setup.

Disclaimer:The content included in this guide is based on our understanding of tax law at the time of publication. It may be subject to change and may not be applicable to your circumstances, so should not be relied upon. You are responsible for complying with tax law and should seek independent advice if you require further information about the content included in this guide. If you don't have an accountant, take a look at our directory to find a FreeAgent Practice Partner based in your local area.